Medical Coverage

We value your and your family’s health and well-being. That’s why we offer comprehensive medical coverage to provide all the benefits and resources you need to support your health throughout the year.

To better evaluate the coverage and features available to you, please review the following brief summary of benefits.

Selecting a Plan That’s Right for You

Choosing the right medical plan takes careful consideration. Before making your decision, be sure to look closely at these factors:

- Choice: Some plans offer greater provider and facility networks than others. If you prefer to seek services both in and out of the network, choose a plan that offers higher levels of coverage and gives you the flexibility to select your provider.

- Coverage: Whether routine, surgical, prescription or another type of coverage, determine if the plan covers the services and medical treatments you value most.

- Cost: Each plan contains a variety of cost components. Consider the amount of your payroll deduction, as well as other plan expenses such as deductibles, copayments or coinsurance.

Medical Plan Comparison

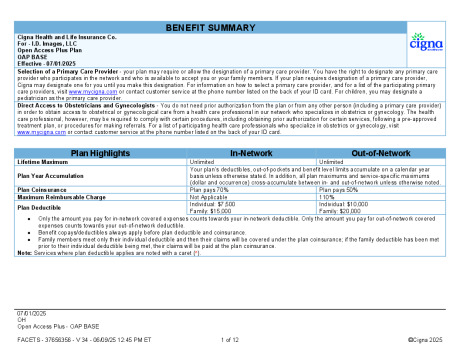

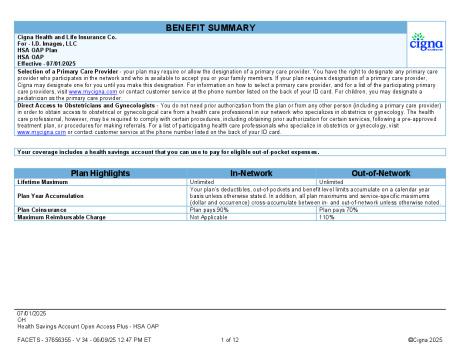

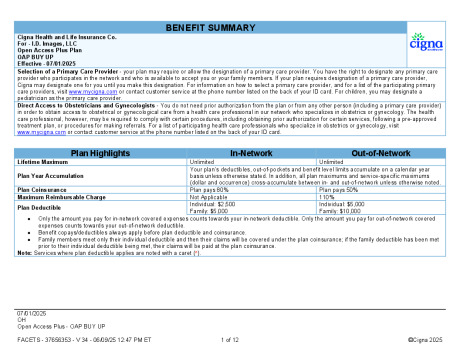

Medical coverage is provided through Cigna. The medical coverage includes a national network of physicians, specialists and hospitals. I.D. Images offers employees medical coverage through UHC’s High deductible and Surest Network. Below is a snapshot of what is covered under the plan. To see a full, comprehensive list, please refer to the Summary of Benefits.

| OAP $7,500 (Base) | OAP $2,500 (Buy-up) | HDHP $3,750 w/ HSA | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Benefit | In-Network | Out-of-Network | In-Network | Out-of-Network | In-Network | Out-of-Network | |||

| Contract Year Deductible | $7,500 Individual / $15,000 Family |

$10,000 Individual / $20,000 Family |

$2,500 Individual / $5,000 Family |

$5,000 Individual / $10,000 Family |

$3,750 Individual / $7,500 Family |

$9,000 Individual / $18,000 Family | |||

| After Deductible Plan Pays | 70% | 50% | 80% | 50% | 90% | 70% | |||

| Contract Year Out-of-Pocket Maximum (includes Rx) | $9,200 Individual / $18,400 Family | $25,000 Individual / $50,000 Family | $7,500 Individual / $15,000 Family | $15,000 Individual / $30,000 Family | $6,450 Individual / $12,900 Family | $25,000 Individual / $50,000 Family | |||

| Lifetime Maximum | Unlimited | Unlimited | Unlimited | ||||||

| Preventive Care for Adults & Children | 100% | 50%, after deductible | 100% | 50%, after deductible | 100% | 70%, after deductible | |||

| Doctors Office Visits Primary Care / Specialist | $50 copay / $75 Copay after deductible |

50%, after deductible | $35 copay / $50 Copay |

50%, after deductible | 90%, after deductible | 70%, after deductible | |||

| Inpatient / Outpatient Facility Charges | 70%, after deductible | 50%, after deductible | 80%, after deductible | 50%, after deductible | 90%, after deductible | 70%, after deductible | |||

| Emergency Room Facility Charges* | $500 Copay | $500 Copay | 90%, after deductible | 70%, after deductible | |||||

| Urgent Care | $75 Copay | 50%, after deductible | $75 Copay | 50%, after deductible | 90%, after deductible | 70%, after deductible | |||

| Complex Imaging (MRI, CAT, PET) | 70%, after deductible | 50%, after deductible | 80%, after deductible | 50%, after deductible | 90%, after deductible | 70%, after deductible | |||